I think I have found the source of the Great American Recession.

After lots of time spent reading various articles on Seeking Alpha and The Pragmatic Capitalist, I have to agree that the source of the economic malaise is over-indebted consumers trying to deleverage their personal debt.

This effects an enormous drop in consumer spending that cripples the broader economy as a whole, as is evidenced by the unemployment rate. When this weakness is combined with sovereign debt issues in Europe and ill-directed spending by the Congress, you have a viral cocktail.

Now, you have the Federal Reserve coming along and trying to whip up the masses with a campaign of placebos and misinformation, hoping that the fundamentally impotent quantitative easing(QE) will somehow increase the stock accounts of American investors, thereby causing them to begin spending via the illusory "wealth effect".

Unfortunately for Bernanke, American consumers are afraid. Afraid of the future and uncertain of our ability to remain prosperous. It is this fear that completely immunizes the economy to the hoped-for wealth effect. Americans are busy paying off debt or stashing away savings to account for uncertainty.

So, what is the good news?

The good news is that this means that American consumers are waking up to the idea that we cannot buy everything we want with imaginary money (aka consumer credit). A little economic catastrophe is all that it takes to get Americans to be responsible with their finances again.

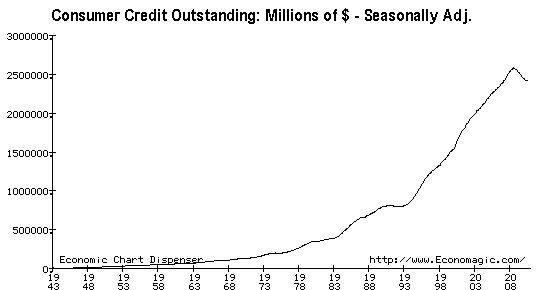

A look at the chart below will reveal how far out of whack most American consumers have gone over the past 20 years.

As you can see, the debt deleveraging cycle is only just beginning as American consumers spend all of their discretionary income trying to pay off houses, boats, cars, jet skis, and whatever other wild purchases that the average American consumer made over the past 10 years. Until this number comes back down to reality, we will be in an economic recession. At the current rate, it will probably be another 8 to 15 years before the average American consumer has enough debt paid off that they will actually have discretionary income with which to spend again.

So, then why is the Fed starting round 2 of QE?

They have said in the past that the purpose of QE, was to stimulate inflation by debasing the value of the US dollar. Although, this is fundamentally incorrect, the market believes in the Fed (sometimes irrationally so) and trusts that they have the power to effect the necessary changes to turn the economy around.

Unfortunately, the Fed's hands are tied right now, so they are bluffing and trying to use psychology to effect a change. They begin by telling everyone that QE2 will put a lot of extra money into circulation and begin to cause price inflation by way of dollar debasement, despite the fact that all they are actually doing is "stocking the shelves with more apples" for the American consumer to ignore. Lucky for Ben though, the market is irrational, and acts in accordance with what they believe will happen regardless of the underlying fundamental truths.

Now, when the Fed comes out and says; "Our earlier use of this policy approach had little effect on the amount of currency in circulation or on other broad measures of the money supply, such as bank deposits. Nor did it result in higher inflation," (1) everyone is left with questions in their mind.

So the goal of QE is to devalue the dollar, and yet Ben Bernanke states that it will not accomplish this fundamentally. So one has to ask again, why are they doing this?

The intended result is to cause the dollar to marginally devalue and simultaneously cause the stock market to surge without actually changing anything fundamentally. QE2 is a grand ruse of epic proportions. Bernanke is relying on psychology alone to push asset prices up to allow for companies to begin making money again and start hiring.

The problem is that there are some unintended consequences with this kind of misinformation and smoke and mirrors campaign. The uncertainty of Americans, as well as investors abroad, is increased; since no one really knows what is happening and whether it will actually help. This causes commodity prices to continue to surge as uncertainty continues to mount. Rising commodity prices cut into the profits that corporations rely upon to continue to build and expand businesses. When you combine this with the possibility for a corporation's health care costs rising, this results in corporations being much less willing to hire.

Yet another side effect of this campaign is that foreign nations, who also believed that the intent of QE was to devalue the dollar, run into issues with liquid capital flowing into their economies as a safe haven of growth, causing their currencies to rise in relation to the dollar and for their exports to be less competitive abroad.

We have to wonder then if all of this psychological tinkering will actually result in a lasting change. Either Bernanke will succeed in inducing this imaginary rally into real positive economic change, or he will simply cause all of our global neighbors to hate us more, all while accomplishing nothing fundamentally for the American people at home. Maybe when every other country in the world sees that this is just a smoke and mirrors campaign, they won't hate us quite as much. Though, I doubt they (or the American investor) enjoy being deceived...

What can we, as Americans, do to help reverse this problem?

Really, we are already doing it. Paying off excessive debt is the first step to economic recovery. This will be a slow and painful process, but once it is completed, the American economy can begin again with real growth, as opposed to the imaginary growth that we saw in the past two decades. Once you have your debts paid off and are secure in a job, you need to plan out a balanced budget that allows you to live within your means, and gives you the opportunity to save for larger purchases.

Live smart, enjoy life, and spend the money that you do have responsibly.

1. "What the Fed did and why: supporting the recovery and sustaining price stability", Ben Bernanke, Washington Post Op-Ed, 4 Nov 2010

2. "Economy-Cleansing Consumer Retrenchment Still Hasn't Happened Thanks to Fed", Andy Sutton, Seeking Alpha, 5 Nov 2010

Wow!! What an education you have gathered over the summer!!!

ReplyDelete